Introduction to Morning Star Trading

Morning Star Trading is a widely used candlestick pattern in technical analysis, particularly in financial markets like stocks, forex, and commodities. Traders often rely on this pattern to identify potential bullish reversals and make informed trading decisions. Understanding the intricacies of Morning Star Trading can significantly enhance a trader’s ability to navigate market trends effectively.

Understanding Candlestick Patterns

Before delving into Morning Star Trading, it’s crucial to have a solid grasp of candlestick patterns. These patterns are visual representations of price movements over a specific period, typically displayed as bars or “candles.” Each candle provides information about the opening, closing, high, and low prices, allowing traders to analyze market sentiment and forecast future price movements.

The Three Components of Morning Star Pattern

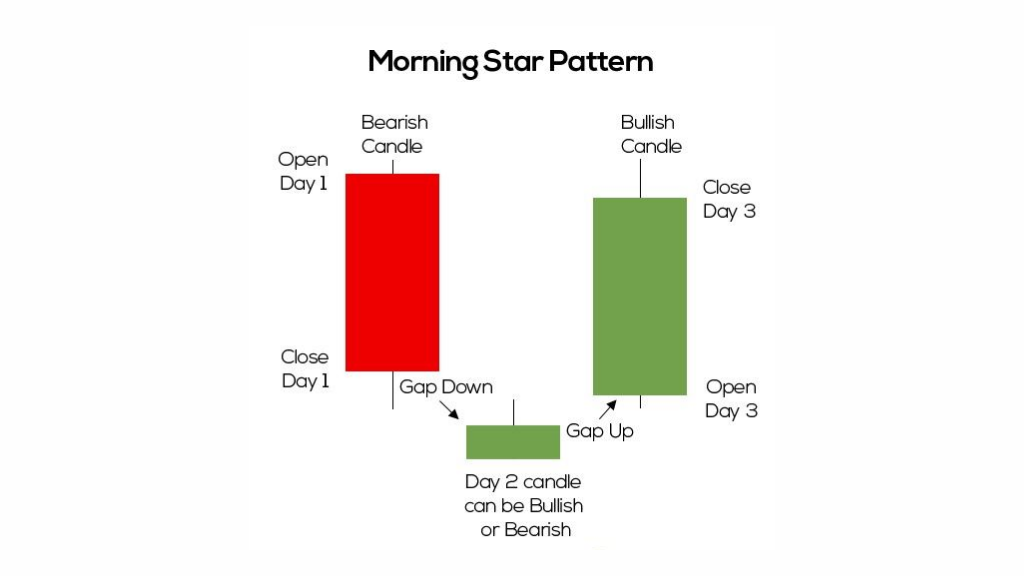

The Morning Star pattern consists of three key components that traders closely monitor:

- The First Red Candle: This initial candlestick is usually bearish, indicating a downward price movement.

- The Small-Bodied Candle: The second candlestick is smaller in size, often signaling indecision or a potential reversal.

- The Third Green Candle: The final candlestick is bullish, opening higher than the previous close and closing above the midpoint of the first candle, suggesting a bullish reversal.

Interpreting Morning Star Pattern

Traders interpret the Morning Star pattern as a bullish reversal signal, signaling a potential shift from a bearish trend to a bullish one. The pattern reflects a transition in market sentiment, with buyers gaining strength and possibly driving prices higher in the near future.

Confirmation and Validation of Morning Star Pattern

While spotting the Morning Star pattern is essential, traders often seek confirmation from other technical indicators or patterns to validate the signal. Volume analysis, trendlines, and oscillators like the Relative Strength Index (RSI) can provide additional confirmation, increasing the reliability of the Morning Star pattern.

Application of Morning Star Trading Strategy

Now that we’ve covered the basics, let’s explore how traders apply the Morning Star trading strategy in real-world scenarios.

Identifying Potential Entry Points

Traders typically look for Morning Star patterns after a prolonged downtrend or during a period of market consolidation. Identifying these patterns at key support levels or trendline confluences can provide strong entry signals for bullish trades.

Setting Stop-Loss Levels and Targets

Risk management is crucial in trading, and traders often use stop-loss orders to limit potential losses if the market moves against their positions. Setting stop-loss levels below the low of the third candle in the Morning Star pattern can help protect capital in case of adverse price movements. Additionally, traders establish profit targets based on technical analysis or key resistance levels to lock in gains.

Backtesting and Historical Performance

To assess the effectiveness of the Morning Star pattern, traders often conduct backtesting on historical data. Backtesting involves analyzing past price movements to determine the success rate and profitability of trades based on the Morning Star pattern. This process helps traders refine their strategies and gain confidence in their trading approach.

Limitations and Challenges

While Morning Star Trading can be a powerful tool, it’s essential to recognize its limitations and challenges.

False Signals and Whipsaws

Like any trading strategy, Morning Star patterns are not immune to false signals or whipsaws. Traders may encounter instances where the pattern fails to materialize into a meaningful bullish reversal, leading to potential losses if not managed properly.

Market Volatility and External Factors

Market conditions and external factors such as economic events, geopolitical news, or sudden shifts in sentiment can impact the efficacy of the Morning Star pattern. Traders must remain vigilant and adapt their strategies accordingly to navigate volatile market environments.

Alternative Candlestick Patterns

In addition to the Morning Star pattern, traders may explore alternative candlestick patterns that indicate bullish reversals.

Hammer and Inverted Hammer Patterns

The Hammer and Inverted Hammer patterns are similar to the Morning Star and often signal bullish reversals, especially when found at the end of a downtrend.

Bullish Engulfing Pattern

The Bullish Engulfing pattern occurs when a larger bullish candle completely engulfs the previous bearish candle, suggesting a shift in momentum and a potential bullish reversal.

Three White Soldiers Pattern

The Three White Soldiers pattern consists of three consecutive bullish candles with higher highs and higher lows, indicating strong buying pressure and a potential uptrend reversal.

Combining Morning Star with Technical Indicators

Traders often combine the Morning Star pattern with technical indicators to enhance their trading signals and confirmations.

Moving Averages

Using moving averages, such as the 50-day or 200-day moving average, can help traders identify the overall trend direction and validate Morning Star signals that align with the prevailing trend.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. Traders can use the RSI to confirm overbought or oversold conditions and validate Morning Star patterns.

Volume Analysis

Analyzing trading volume during the formation of Morning Star patterns can provide insights into the strength of the reversal signal. Increasing volume during the bullish candle confirms buyer participation and conviction.

Psychology Behind Morning Star Trading

Understanding the psychological aspects of Morning Star patterns is crucial for traders to grasp market sentiment and investor behavior.

Shift in Market Sentiment

The formation of a Morning Star pattern reflects a shift in sentiment from bearishness to bullishness. Traders interpret this shift as an opportunity to enter long positions and capitalize on potential upward price movements.

Investor Confidence and Conviction

As the Morning Star pattern suggests a bullish reversal, investors and traders gain confidence and conviction in the market’s upward potential. This newfound optimism can fuel buying activity and drive prices higher.

Real-World Examples and Case Studies

Examining real-world examples and case studies can provide valuable insights into the practical application of Morning Star Trading.

Case Study 1: Stock Market

In the stock market, a Morning Star pattern forms on the daily chart of Company XYZ after a prolonged downtrend. Traders identify the pattern, confirm the signal with increasing volume, and enter long positions. Subsequently, the stock experiences a bullish rally, validating the Morning Star pattern.

Case Study 2: Forex Market

In the forex market, a Morning Star pattern appears on the four-hour chart of a currency pair following a period of consolidation. Traders recognize the pattern, validate it with RSI divergence, and initiate buy trades. The currency pair then undergoes a bullish reversal, aligning with the Morning Star signal.

Trading Across Different Markets

Morning Star Trading is applicable across various financial markets, offering traders opportunities in diverse asset classes.

Stocks

Traders can apply Morning Star patterns to individual stocks, indices, or ETFs, identifying potential bullish reversals and trading opportunities.

Forex

In the forex market, Morning Star patterns can signal shifts in currency pair trends, providing entry signals for traders seeking to capitalize on currency movements.

Commodities

Commodities such as gold, silver, and oil also exhibit Morning Star patterns, allowing traders to analyze price reversals and make informed trading decisions.

Cryptocurrencies

The volatile nature of cryptocurrencies makes them ideal for Morning Star Trading strategies, with patterns often forming on cryptocurrency charts.

Expert Tips and Best Practices

Seasoned traders often share tips and best practices for successful Morning Star Trading.

Tip 1: Patience and Discipline

Exercise patience and discipline when trading Morning Star patterns, waiting for confirmation signals and avoiding impulsive decisions.

Tip 2: Risk Management

Prioritize risk management by using stop-loss orders, position sizing, and proper risk-reward ratios to protect capital and minimize losses.

Tip 3: Continuous Learning

Continuously educate yourself about technical analysis, candlestick patterns, and market dynamics to improve your trading skills and stay ahead of trends.

Conclusion and Summary

Morning Star Trading is a valuable tool for traders seeking to identify bullish reversals and capitalize on market opportunities. By understanding the components, application, limitations, and best practices of Morning Star patterns, traders can enhance their trading strategies, mitigate risks, and achieve consistent success in financial markets. Continuous learning, risk management, and disciplined execution are key principles for traders embracing the world of Morning Star Trading and technical analysis.

FAQs with Answers:

What is Morning Star Trading?

Morning Star Trading is a technical analysis strategy that identifies potential bullish reversals using candlestick patterns, particularly the Morning Star pattern.

How does the Morning Star pattern signal bullish reversals?

The Morning Star pattern consists of three candles – a bearish candle, a small-bodied candle, and a bullish candle, indicating a shift from bearish sentiment to bullish sentiment.

What are some key components of a successful Morning Star trading strategy?

A successful Morning Star trading strategy includes identifying high-probability setups, confirming signals with technical indicators, practicing risk management, and continuous learning.

Can Morning Star Trading be applied to different financial markets?

Yes, Morning Star Trading is applicable to various markets, including stocks, forex, commodities, and cryptocurrencies, offering traders versatile opportunities for bullish reversals.

What are some common mistakes to avoid in Morning Star Trading?

Common mistakes to avoid in Morning Star Trading include relying solely on candlestick patterns without confirmation, neglecting risk management, overtrading, and ignoring market fundamentals.